Role of Artificial Intelligence in Banking Sector

The keeping money sector’s investing on Generative AI is assessed to develop to US$84.99 billion by 2030 at a 55.55% CAGR. Concurring to the Statista Report, the keeping money segment was the driving financial specialist in Fake Insights in 2023 with US$20.6 billion.

These assessments uncover the noteworthiness of Generative AI in the keeping money segment. Leveraging machine learning innovation, Generative AI makes special substance and information bits of knowledge. Concurring to McKinseyGlobal Founded, Generative AI has the potential to deliver $2.6 trillion to $4.4 trillion annually over the considered 63 utilize cases.

Also, the keeping money segment is composed to get benefits from it with an yearly plausibility of $200 billion to $340 billion from hoisted productivity.

From giving credit chance evaluation to extortion location to sending Shrewd Chatbots, Generative AI utilize cases in managing an account have revolutionized the industry. Need to know more almost it? Let’s have a point by point dialog on utilize cases and applications of Generative AI in the managing an account sector

Introduction of Generative AI in Banking

Generative AI’s capacity to distinguish designs, assess expansive datasets, and make superior choices has benefitted the industry in various ways.

Some real-world illustrations of Generative AI’s utilize in the keeping money division are RBC Capital Markets’ Aiden Stage, Wells Fargo’s Prescient Keeping money Include, and PKO Bank Polski’s AI Solutions.

Alongside, it moreover makes difference in extortion discovery and avoidance, credit scoring, personalizing client involvement, utilizing virtual colleagues, exchanging strategies, contract endorsement, and numerous more.

Generative AI has exceedingly affected the managing an account and fund industry, which has been useful in expanding the generally ROI.

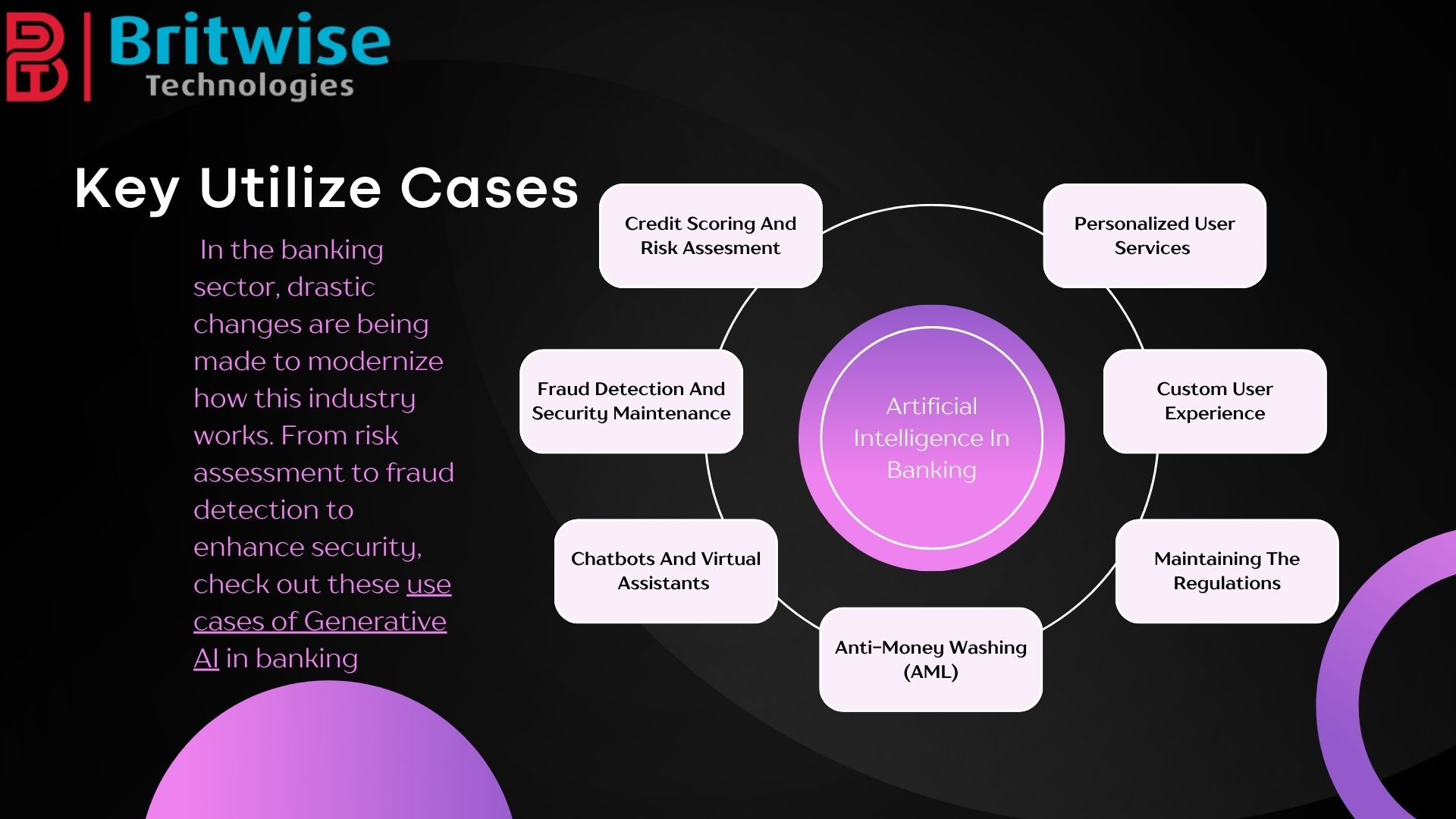

Generative AI in Keeping money: Have a see at Key Utilize Cases

Undoubtedly, Generative AI has gigantic potential to revolutionize any industry. In the keeping money segment, extreme changes are being made to modernize how this industry works. From hazard appraisal to extortion location to improve security, check out these utilize cases of Generative AI in banking:

1. Credit Scoring & Chance Assessment

In keeping money, AI-enabled information experiences offer assistance experts with exact credit scores, driving to making advance endorsement choices. Gen AI produces manufactured information to prepare models and make strides exactness. Already, credit hazard appraisal was based as it were on factual models and verifiable information. Presently, Generative AI has presented a modern way by assessing expansive datasets and making credit-scoring models.

This modern strategy analyzes the financial soundness of a candidate based on their social information, exchange history, and financial pointers. It enables banks to make loaning choices quicker and with more accuracy.

2. Extortion Discovery & Prevention

Producing manufactured information by applications of Generative AI in the managing an account space mirrors false designs whereas moving forward their discovery calculations. With the ceaselessly changing procedures of fraudsters, it is getting to be troublesome for the keeping money segment to identify them. Utilizing engineered information makes a difference them to outperform false schemes.

A generative AI-enabled extortion discovery framework is moreover planned particularly to screen exchanges and assess irregularities reliably. Actualizing machine learning models has moreover been advantageous for analyzing chronicled exchange information and making prescient models to see wrong designs as before long as they alter or evolve.

3. Chatbots and Virtual Assistants

Customer fulfillment is a best concern for each industry. In the managing an account industry, they are actualizing Generative AI-powered Chatbots created by an AI chatbot advancement company to give clients with raised encounters and lock in them for a long time. This application of Generative AI in keeping money encourages the industry with human-like discussions, 24*7 moment help, and arrangements to customers’ queries.

These Chatbots make client intelligent personalized and consistent whereas giving related reactions. Whether it is almost getting exchange points of interest, setting up the account, checking account adjust, or other issues, clients can effectively inquire the Chatbot for an moment answer.

Also, these Chatbots and virtual colleagues accumulate important client information and input, empowering keeping money experts to give way better services.

4. Compliance and Administrative Services

The managing an account division is exceedingly unstable and must comply with strict directions. It comprises watching exchange exercises, assessing the frameworks, combining related information, and exchanging it to the related authorities.

Applications of Generative AI in managing an account offer assistance to decrease the burden of compliance administration. AI-generated manufactured information empowers budgetary organizations to analyze, handle, and control their frameworks by means of compliance testing.

Further, it leads to way better exactness and effectiveness, along with modernizing the approach to bank tests and reports. Banks moreover utilize Generative AI applications to evaluate customers’ information and give a ensure to comply with the KYC Act some time recently tolerating an account.

5. Algorithmic Exchanging & Investment

Banks are applying Generative AI frameworks to make strides current exchanging and venture procedures. Generative AI models enable money related educate by distinguishing chronicled advertise information, making exchanging signals, and analyzing patterns.

The managing an account division no longer exchanges based on standard procedures. Instep, it directs its methodology in real-time, giving a more versatile approach to exchange and shrewd decision-making.

Also, the utilize of Generative AI models empowered them to respond to the current advertise condition and the most recent patterns. This comes about in executing more viable exchanging and speculation techniques to decrease dangers and maximize returns.

6. Personalized Client Services

Generative AI in keeping money has discarded conventional ways of giving client administrations. The industry has received different compelling strategies to provide personalized administrations to its clients. It has begun analyzing customers’ information and inclinations, counting investing designs, exchange history, and monetary purposes.

Generative AI calculations offer assistance Banks and money related organizations make tailor-made proposals based on each customer’s person circumstances. These administrations incorporate sending clients charging request, installment updates, account administration, etc. It appears that personalized administrations have different benefits for both clients and the industry.

7. Anti-Money Washing (AML)

The essential reason of executing applications of Generative AI in keeping money is to block cash washing and compliance with administrative prerequisites. With time, Generative AI has demonstrated an fabulous approach to making strides AML hones. Banks can analyze expansive datasets related to customers’ profiles, exchange information, and investing designs to avoid noxious attacks.

Generative AI’s capacity to give prescient models can distinguish unpredictable designs showing cash washing. These models too analyze modern information, making them able to distinguish conceivable dangers. AML hones are moreover advantageous for lessening untrue positives, recognizing peculiarities, and more. It will offer assistance monetary experts to elude overwhelming fines, make strides their notorieties, and keep up their unwavering quality among clients.

Amazing Benefits of Generative AI in Banking

The expanding utilize of Generative AI in managing an account, particularly in ranges like Portable Managing an account App Improvement, delineates a few benefits of this innovation. From made strides security to precision, superior decision-making to one of a kind encounter, there are different benefits you must know:

- Better Hazard Management

Applications of AI in keeping money offer assistance to assess tremendous budgetary information to create precise credit scores, driving to way better credit chance evaluations and decision-making. It makes a difference experts utilize prescient bits of knowledge to address challenges, defend resources, and make the most of showcase opportunities.

- Improved Operational Efficiency

By computerizing schedule assignments (compliance checks, information passage, and report handling), the managing an account division can speed up its operations whereas advertising more esteem to its clients and tending to current challenges.

- Elevated Client Experience

Customers are presently helped with custom-made administrations and proposals on all the apps and websites through applying Generative AI in the keeping money segment. It makes a difference to provide them an increased and personalized experience.

- Better Decision-making

Bank experts and other money related specialists make choices based on information experiences created by Generative AI. These experiences can too be valuable to avoid and reduce dangers whereas maximizing budgetary development in unsteady showcase situations.

- Robust Security & Privacy

Generative AI utilize cases in keeping money are utilized to keep customers’ information secure whereas keeping up their protection. It is invaluable for banks to remain arranged when they are managing with false exercises and online dangers in real-time.

- Regulatory Compliance

Nowadays, banks and other budgetary educate utilize Generative AI applications to guarantee compliance with administrative prerequisites. These AI-enabled arrangements are too useful in assignment mechanization, easing costs and fines.

Conclusion

Generative AI in keeping money is going to change the whole industry by executing progressed arrangements to mechanize assignments, improve security, and hoist customers’ encounters. Utilizing Keen chatbots and other virtual collaborators, banks can give clients with 24/7 help and bolster to illuminate their queries.

However, understanding challenges will be similarly significant in scaling up Generative AI utilize cases in the managing an account division. Grasping Generative AI and its extraordinary capabilities will bring modern openings to the managing an account and fund domain. It will lead to a critical move towards more customer-centric, spry, and spearheading money related services.

Britwise Technologies is here to help you on your Generative AI travel with a group of learned and talented designers. As a driving Generative AI Application Development company, we have made a different type of various successful Fintech Applications which keeping money segment with bespoke arrangements that give greatest exactness and speed.

Connect with us, and we will be upbeat to direct you!